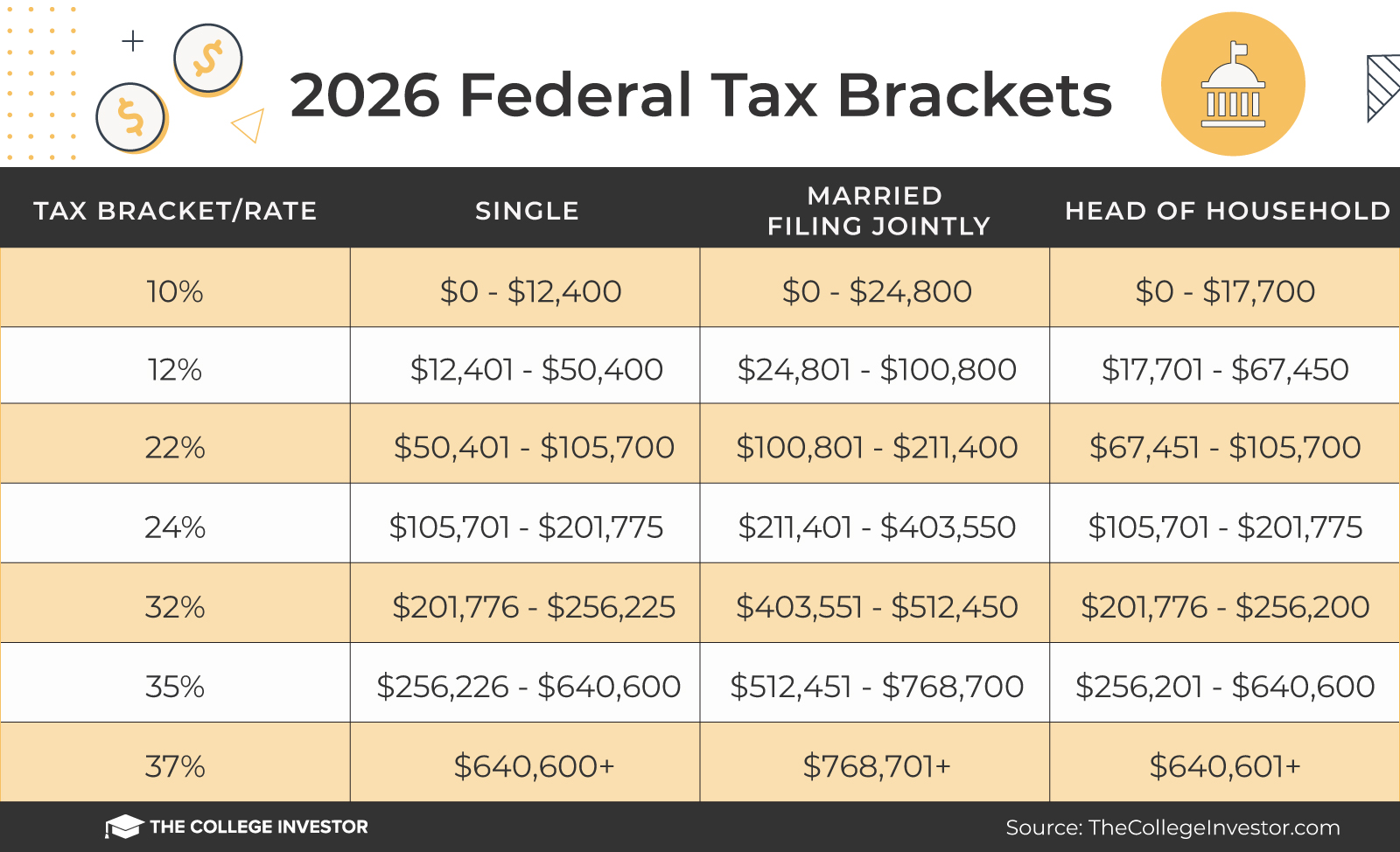

Every year tax season rolls around and millions of Americans begin to prepare for it. However, not everyone understands the federal tax brackets. With the 2026 tax season fast approaching It’s very important that you know the changes that will impact your financial planning and filing strategy. Federal tax brackets will determine the percentage of your income that actually goes to the IRS. Even a tiny adjustment is liable to make a big difference in how much you owe the government or can save.

This infographic breaks down the federal tax brackets in a way that is clear and visual. This way you can easily identify where your income lies. You’ll be able to see just how each package will correspond with your different income levels. The marginal tax rates that apply to you and exactly how these rates compare to other years.

It doesn’t matter if you are self-employed, managing your Investments or in a traditional job, understanding your tax bracket is going to help you to make wiser financial decisions throughout the year.

If you are ready to stay ahead of your taxes and get the most out of your deductions and credit then this visual guide is the best place to start. Take a look at the infographic below to see exactly how the 2026 brackets will be structured and what they will mean for your overall financial health.

Infographic designed by Federal Tax Brackets

Want More Info? How about a Free 30-minute Consult with Ascend?

Schedule Your Free Consultation Now!

Special thanks to the following source(s) for the image(s) used in this article:

Enjoy a Great Podcast? ?

Check out this Remarkable episode to continue the conversation and help you grow!

How to Take the Driver’s Seat and Achieve 5-Year Goals in 2 Years with David Wood

"Are you digging a hundred holes three feet deep, or are you going deep for the gold?" ~ David WoodWATCH THE PODCAST Click the play button ▶️ above 👆 to watch now! Please Note: You can skip any ads after 5-seconds by clicking, "Skip Ad" in the bottom-right corner of the video window. These are not ads we control, or necessarily endorse. They are delivered by the video hosting company, YouTube or Rumble. Thank you for understanding....

Listen Now!

Listen Now!

DISCLAIMER: This is an affiliate article. We post affiliate articles with the intent of helping you grow. They are not written, researched, or necessarily endorsed by our team. They are simply content submitted to us by what appears to be respectable affiliate sources, people, and organizations, which upon initial review, seem solid and helpful to our community, so we post them. It is up to you to personally verify the facts, links, organizations mentioned, the validity of the information presented, and any/all claims made in the article(s). To report an issue with any of the information, links, or organizations mentioned in this, or any content posted on our website, or if you simply have a question or need something we can help you with, please contact us now.