5 Things You Shouldn’t Skimp on To Become Financially Stable

You know the feeling; you wake up every day, put on your pants, and head to work. You do your job, go home, have dinner with the family, and then once everyone has gone to bed, you stay up late worrying about how you will pay for this month’s expenses. With all of that worry, it is no surprise that many people are financially struggling these days. The good news is that there are some things you can do now to avoid financial struggles down the line.

Don’t Fail To Supplement Your Income

Before you start a business, it is crucial to supplement your income. Only when you have a stable source of supplemental income can you truly devote yourself to starting and running a successful company that will be financially sustainable long-term.

For example, if you have a driver’s license, you can work in Amazon as a driver part-time. You might be thinking, how much does an amazon driver make? All that information is online. Furthermore, it depends on how flexible your schedule is, but it’s an excellent way to supplement your income.

Don’t Fail To Pay Your Debts

Paying off your debts is essential because it shows that you are financially responsible and allows for a better credit score. In addition, it is vital to pay off your debts on time and in full; this helps build trust with creditors.

This one is simple. If you have debt, pay it down – don’t be afraid to put everything else on the back burner until that’s taken care of before moving forward in your life. Your credit score will thank you for being responsible by paying off debts and not letting them linger around long enough to affect your financial stability.

Don’t Fail To Gain Financial Literacy

Financial literacy is critical and can help you for the rest of your life.

If you don’t learn about finance at a young age, it’s hard to understand as an adult without learning on your own time, which takes time away from other things like family and work.

Furthermore, schools should teach financial literacy so that more people understand how money works before relying on their knowledge to support themselves later down the road.

Don’t Skimp on Saving

Saving is an integral part of becoming financially stable, and you wouldn’t want to stop doing it.

Consider saving for your retirement or a large purchase in the future and while doing this you have to learn to separate personal and business affairs in order to avoid confusing yourself . You can start by opening up a savings account at your bank with some money from each paycheck. It’s also helpful to keep track of any financial goals you have so you know how much you need to save while staying within budget limits.

Use The Right Types Of Savings

When most people think of savings, they usually envision a specific type of account they have with their bank. While these can often be recommended, they’re far from the only options you have. There are multiple other ones you can choose from, such as fixed index annuities.

Each option offers its pros and cons, making it worth weighing them against each other when you’re making a decision. Some could be much more appropriate for you than others and could have more of an impact on your financial stability than others. Take the time to know what’s right for you.

Don’t Ignore Smart Investment Tools

While saving and budgeting are fundamental, investing wisely is just as crucial in achieving long-term financial stability. Tools and indicators can help guide your decisions so you’re not investing blindly. For those interested in trading or diversifying their portfolio, understanding market movements and potential outcomes is key. One tool that stands out for helping traders make informed decisions is the MT5 Risk Reward Ratio. This indicator provides a visual representation of the potential profit relative to the risk on any given trade, allowing users to approach investing with more strategy and less emotion. By incorporating smart tools like this into your financial planning, you’re better equipped to build wealth over time and avoid costly missteps.

Don’t Skimp on Opening an Emergency Account

An emergency fund is a savings account you create to manage your finances and set aside money for unexpected expenses. It’s just like the piggy bank kids have, only with actual dollars in it. This way, when something goes wrong or life throws you curveballs, there will be some ready cash to help get through whatever may come your way.

An emergency account can help you build your side hustle, or if your side hustle is doing great, you can chip in money to your account. After all, if you don’t save any at all and have nothing else but your clothes on your back, then things would probably get pretty dicey quickly. So don’t skimp out on opening an emergency account because not having one could leave you financially unstable.

Conclusion

In conclusion, becoming financially stable requires you to take several steps. First, do not skimp on supplementing your income by looking for other ways to make money aside from your primary job. Second, don’t fail to pay off debts that have been causing you stress and anxiety in the first place. Third, gain financial literacy so that you can better manage your finances in the future. Lastly, never skimp out on saving money, and make sure an emergency fund is always available if something unfortunate comes up in life.

Follow these tips when getting started with proper personal finance management today.

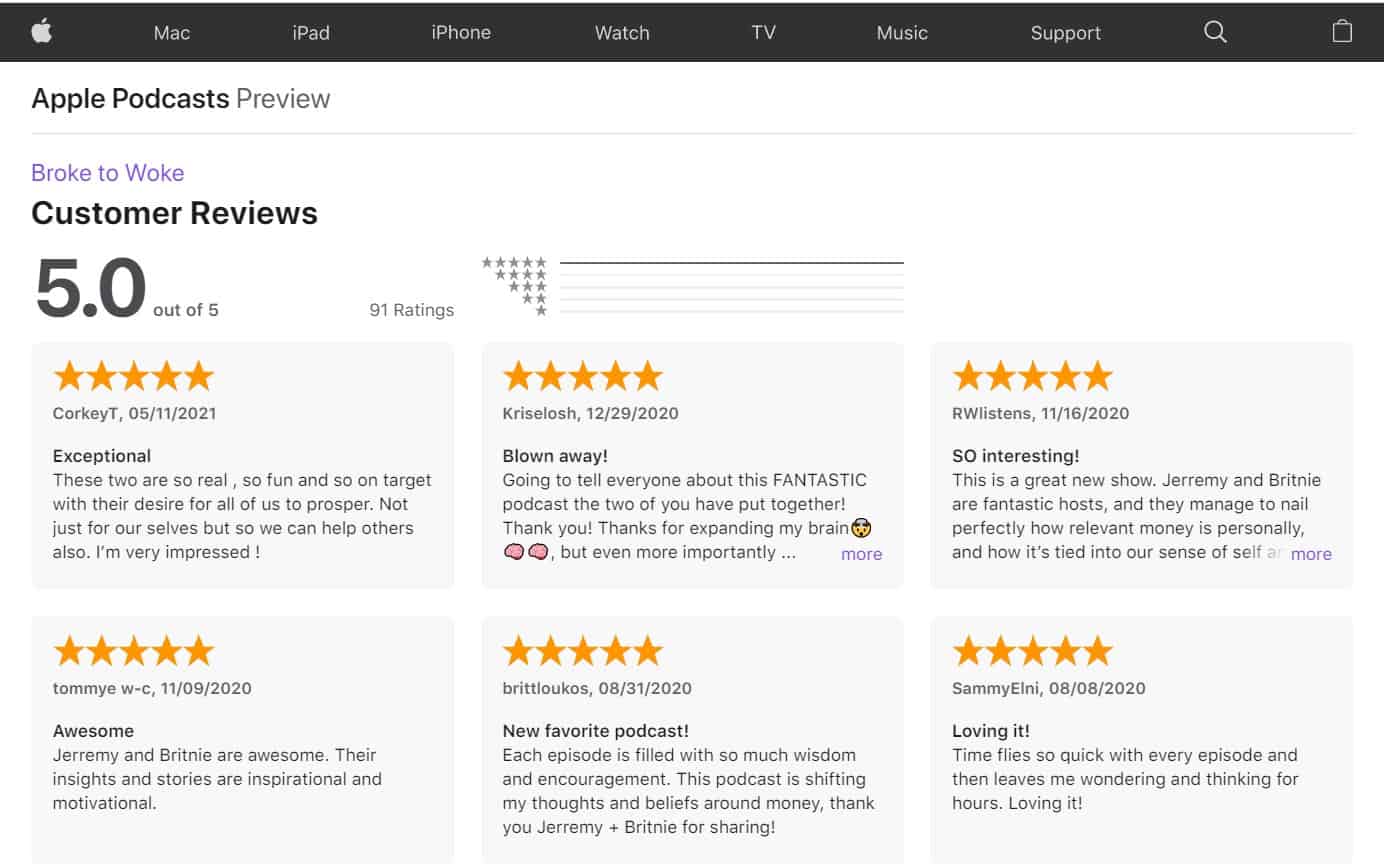

Enjoy a Great Podcast? 🤓

Here’s a Remarkable episode to continue the conversation and help you grow!

Jerremy Newsome | From Broke to Woke: Learning to Invest & Beating Alcoholism | Real Life Trading

So what happens when you introduce a young man to investing, cults, and alcohol all before the age of 18? You get an amazing journey of success, failure, self-sabotage, redemption, and growth. Welcome to this weeks episode of the Remarkable People Podcast, the Jerremy Newsome story!

In this episode you’ll earn how Jerremy learned to create great wealth through investing and real life trading, how he freed himself from the oppression of a cult and alcoholism, how he came to start the Broke to Woke Podcast, and many more powerful life lessons and stories. Plus, like most of our Remarkable episodes, you’ll not only hear what Jerremy did, but he shares with us HOW he did it so you can beat and overcome these areas of life too!

📺 Click Here to Watch or Listen Now! 🎧

THANKS FOR LISTENING TO THE REMARKABLE PEOPLE PODCAST! 🎈

Click Here for More Remarkable Episodes on Almost Any Topic You Can Imagine.😃

DISCLAIMER: This is an affiliate article. We post affiliate articles with the intent of helping you grow. They are not written, researched, or necessarily endorsed by our team. They are simply content submitted to us by what appears to be respectable affiliate sources, people, and organizations, which upon initial review, seem solid and helpful to our community, so we post them. It is up to you to personally verify the facts, links, organizations mentioned, the validity of the information presented, and any/all claims made in the article(s). To report an issue with any of the information, links, or organizations mentioned in this, or any content posted on our website, or if you simply have a question or need something we can help you with, please contact us now.