“If you want advice from someone, ask for money. If you want money from someone, ask for advice.”

~ David Steele

WATCH THE PODCAST

Click the play button ▶️ above 👆 to watch now!

Please Note: You can skip any ads after 5-seconds by clicking, "Skip Ad" in the bottom-right corner of the video window. These are not ads we control, or necessarily endorse. They are delivered by the video hosting company, YouTube or Rumble. Thank you for understanding.

LISTEN TO THE PODCAST

David Steele | Key Points (Timestamps & Titles):

- 00:05:00 – Growing up poor, insecure, and isolated

- 00:12:00 – Tenacity formed through repeated failure

- 00:20:00 – The 500-dials-a-day discipline system

- 00:27:00 – Leaving stockbroking for fiduciary service

- 00:45:00 – Building One Wealth Advisors

- 01:03:00 – Scaling restaurants, pasta vs pizza decision

- 01:12:00 – Empowering immigrant entrepreneurs

- 01:17:00 – Legacy, philanthropy, and leading with service

Episode Proudly Sponsored by:

Save 30% to 80% on EVERYTHING you order at MyPillow.com, PLUS Free Shipping with the best MyPillow promo code, “REMARKABLE” now!

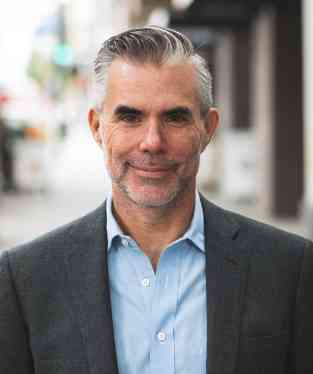

Unwavering Tenacity: Investing, Risk-Adjusted Return & a Life of Serving Others with David Steele

In this powerful episode of The Remarkable People Podcast, host David Pasqualone sits down with entrepreneur, financial advisor, and restaurateur David Steele. Together, they explore the gritty realities of childhood trauma, the discipline behind success, the truth about money and risk, and why the happiest life is one rooted in serving others.

From a childhood marked by instability and financial insecurity to leading two multimillion-dollar companies, David’s journey is a blueprint for resilience, clarity, and purpose-driven leadership.

David Steele: Why Service Is the Foundation of True Happiness

When asked to summarize his life philosophy, David doesn’t hesitate:

“The only way to be happy in life is to be in the service of others.” – David Steele

But that belief didn’t come from comfort — it came from surviving adversity.

David grew up in a financially unstable home after his father left when he was nine. His mother, a young woman without a degree, worked as a schoolteacher making barely enough to support two boys. They came close to food stamps, but she refused out of pride. In a neighborhood full of stable, upper-middle-class families, David was the poor, divorced Jewish kid in a predominantly Italian Catholic town.

He was sensitive, often bullied, and constantly felt like an outsider.

“I didn’t know if we were going to be safe,” he recalls. “And when your basic needs aren’t secure, it’s very hard to think about serving others.”

But that same insecurity developed the grit that would define the rest of his life.

The Turning Point: Tenacity Through Rejection and Repetition

One of the earliest hints of David’s unshakable persistence came in high school — when he was cut from the basketball team four years in a row.

A former business partner once told him, “That says more about who you are than anything else you’ve accomplished.”

It wasn’t talent.

It wasn’t opportunity.

It was tenacity.

This trait would become the key to everything that followed.

David Steele: From Struggling Student to 500-Calls-a-Day Workhorse

David wasn’t a natural academic. He barely scraped through school and bombed his SATs. But when he graduated college, he did something most people never do: he looked up which job paid the most for someone with a bachelor’s degree.

The answer?

Stockbroker.

And so he launched into one of the most intense professional environments imaginable — a Wolf of Wall Street–style brokerage firm where success was measured by one thing: output.

He was handed three things:

A phone.

A desk.

And a sheet requiring 500 calls every single day.

Through this grind, David discovered the secret framework that would guide the rest of his life:

Discipline + math = predictable success.

On average:

500 dials →

70 conversations →

10 qualified leads →

1 client per 100 pitches

He didn’t love the work — but he loved learning the system.

Leaving Money on the Table to Serve People Better with David Steele

Despite earning over six figures by his early twenties, David felt empty.

He realized he wasn’t serving people — he was selling to them.

“I wasn’t adding value. I was appealing to their gambling instincts.”

That moral discomfort drove him to transition to true fiduciary financial planning at Bear Stearns. His income dropped by 70% — and he became happier than ever because he was finally serving clients instead of selling products.

When Bear Stearns collapsed during the 2008 financial crisis and was absorbed by JP Morgan, the entrepreneurial environment disappeared. David knew it was time to build something new.

Building One Wealth Advisors and a Top Restaurant Group

With his brother and partners, David launched One Wealth Advisors, starting with $250 million in assets under management. Ten years later, that number grew to $1.3 billion.

At the same time, David pursued his love of hospitality, co-founding Flour + Water, which has since expanded into a multi-concept restaurant group with:

Multiple restaurant locations

A dried pasta line

A frozen pizza line

A national expansion strategy

His approach to business remains the same as it was on day one:

service, discipline, humility, and systems.

Risk-Adjusted Return: Why Entrepreneurs Should Avoid Debt

One of David’s most powerful teachings is his view on borrowing:

“If you can’t pay cash for it, you’re not ready for it.” – David Steele

He believes almost all debt creates emotional and financial bondage.

Instead of borrowing, he urges entrepreneurs to sell equity.

Here’s why:

Investors can evaluate risk rationally

Entrepreneurs avoid personal financial destruction

Equity creates shared incentives

Downside becomes limited but upside remains significant

Using outside investment is not dilution — it’s protection.

The Power of a Great Pitch (and Why You Should Ask for Advice Before Money)

David teaches entrepreneurs a simple but profound truth:

“If you want advice, ask for money. If you want money, ask for advice.”

By seeking feedback first, you:

Lower the other person’s guard

Honor their expertise

Improve your idea

Turn advisors into investors

Your pitch deck becomes more than a fundraising tool —

it becomes a clarity tool, a credibility tool, and sometimes even a recruiting tool.

David Steele: Legacy, Philanthropy, and Empowering Immigrant Entrepreneurs

David donates 1% of One Wealth Advisors’ profits to charity and matches employee giving. But his long-term vision is even bigger.

In his estate plan, all of his restaurant equity will go to a nonprofit designed to help immigrant restaurant workers access the capital and mentorship needed to break out of low-wage traps and start their own businesses.

He wants to teach them what he learned early:

How to raise capital

How to avoid “buying yourself a job”

How to scale beyond self-employment

How to build generational opportunity

This is where David’s philosophy comes full circle:

serve others, and you create a legacy that outlives you.

Why David Steele’s Story Matters

This episode is about much more than money or business.

It’s about resilience.

It’s about discipline.

It’s about healing your story.

It’s about choosing service over self.

David’s journey shows us that purpose doesn’t come from success — success comes from purpose.

As he puts it:

“I’m imperfect — and that’s okay. What matters is waking up every day asking how you can help someone else live a happier, more peaceful life.”

A remarkable blueprint for anyone searching for meaning, stability, and impact.

REMARKABLE SPECIAL OFFER(S):

REMARKABLE OFFER 1: Save 30% to 80% on EVERYTHING you order at MyPillow.com with Free Promo Code, “REMARKABLE“. Yes, that’s right! Use the best My Pillow promo code out there to save a TON of money on all 200+ quality, comfortable, cozy home goods at MyPillow.com/Remarkable, or by calling 1-800-644-6612. From sheets, to blankets, to pillows, to mattress toppers, be ready to sleep better and live more comfortably than you ever have before!

REMARKABLE OFFER 1: Save 30% to 80% on EVERYTHING you order at MyPillow.com with Free Promo Code, “REMARKABLE“. Yes, that’s right! Use the best My Pillow promo code out there to save a TON of money on all 200+ quality, comfortable, cozy home goods at MyPillow.com/Remarkable, or by calling 1-800-644-6612. From sheets, to blankets, to pillows, to mattress toppers, be ready to sleep better and live more comfortably than you ever have before!- REMARKABLE OFFER 2: Your Exclusive Offer: Save Big on Your Console Vault In-Vehicle Safe. With our exclusive promo code, “REMARKABLE“, you will Save 10% or more on all Console Vault anti-theft vehicle safes you order. And sometimes, you’ll receive Free Shipping too! Just make sure to use the free Console Vault discount code, “REMARKABLE” at checkout.

Full Episode Transcript

Unwavering Tenacity: Investing, Risk Adjusted Return, & the Importance of Service to Others with David Steele

David Pasqualone: [00:00:00] Hello, friend. Welcome to this week’s episode of The Remarkable People Podcast, the David Steele story. This week, David and I had a great time talking with one another. We got to learn about his upbringing, his trials and struggles just like we all have, how they bled into his adult life. We talk about how success without purpose means nothing.

We talk about tenacity. We talk about entrepreneurship. We talk about debt versus capital. We talk about his financial planning, business and experience. We talk about how he has a successful chain of restaurants and the whole time. You and I can glean and be inspired. There’s amazing quotes that you can get from this that you can apply to your life as well and so much more.

I really believe that when you stick with us for the next few minutes, you’re not [00:01:00] only gonna be entertained you, you’re gonna be inspired, and you’re gonna be given some helpful steps to say, yeah, this is what I need to do. I’m gonna be a better human and take my life to the next level. So at this time, get your pen, paper, favorite beverage, and get ready to take notes on our friend David Steele and his Remarkable experience now.

Welcome to the Remarkable People Podcast!: The Remarkable People Podcast, check it out,

the Remarkable People Podcast. Listen, do Repeat for Life,

the Remarkable People Podcast.

David Pasqualone: Hey David. How are you today?

David Steele: I’m [00:02:00] doing great. Thanks for having me. How are you

man? I am fantastic. Remarkable. Even I just spent about 30 to 60 seconds telling our audience about who you are and what to expect, but straight from the source. If our listeners are their first time here today, or if they’ve been with us all seven years, what are you gonna share with us in a nutshell that’s gonna not only highlight your life, but something that our listeners can take and run with to better theirs?

The only way to be happy in life is to be in the service of others.

David Pasqualone: Yeah. I mean, that is so true. The Bible says Love God and love others as thyself. Right. So. We’re gonna talk about your upbringing. We’re gonna talk about the steps that you took. Good, bad, ugly, pretty, pretty ugly to get where you are today.

And then we’ll transition to where David is and where he’s headed next, right after the [00:03:00] short commercial break.

Mike Lindell, Promo Code REMARKABLE: I’m excited to announce that we’re having our biggest three in one sale ever. With a limited edition product, a back in stock special, and a closeout deal you won’t find anywhere else. So go to mypillow.com or call the number on your screen. Use your promo code to get our MyPillow bed cheese only 29 88.

Any color, any style, any size, even Kings, regular 1 19 98, only 29 88. Once they’re gone, they’re gone for good. How about our My towels? They’re finally back in stock, but not for long. Get a six piece my towel set, regular 69 98. Now only 39 98. And for the first time and the only time ever get our limited edition premium.

My pillows, they’re made with Giza Cotton and Designer Gusset Queen 1798. King’s only 1998. So go to mypillow.com or call the number on your screen. Use your promo code to get the best offers ever. Quantities are extremely [00:04:00] limited, so order now.

David Pasqualone: Alright, welcome back to the show. David. We’re talking about service to others. Talk about your life. Where did your life begin? What was your upbringing?

Life? Not ’cause we’re trying to dwell on the past, but everything that happens again, good, bad, ugly, prettier, pretty ugly, makes us the men we are. So what was your upbringing like that made this concept so important to you?

David Steele: Well, it, I mean, my overriding philosophy in life, which again, you asked me to sort of summarize what I hope, what I hope to express to people, really was taught to me about my mother.

And I was raised in pretty difficult circumstances. I don’t have much of an actual memory from before I was eight or nine years old. I I my, my mom woke up one day at the age of 30, having not finished college, having my father essentially leave her. [00:05:00] And my brother and I, I was nine and my brother was three.

And that the situation was pretty sad. I mean, I had said earlier that if you’re not, you’re not gonna be happy. If you’re not in the service of others, it’s really hard to be in the service of others if you’re not, as, I like to say, warm, dry, and fed. In other words, your base needs aren’t met, met, being met, or your, at least you have anxiety around whether your base needs are gonna be met.

And so that that idea of being in the service of others in the name of trying to have peace and happiness for yourself internally really is only possible once you have your base needs being met, you know, you know you’re gonna be safe. And we didn’t know we were gonna be safe. My mom ended up, my mom father was, he didn’t disappear, but he was not supportive very much financially.

And my mom found herself having to finish college and she got a job as a teacher [00:06:00] and I think she was making something like $17,000 a year in the, in the, in the, in the seventies. So, you know, adjuster inflation, it’s still not a lot, but yeah, it’s and. But, you know, we survived and, and so I, I, you know, to call us poor is probably a little bit of an exaggeration, but we were pretty darn close.

I think at one point we actually qualified for food stamps and my mom was too proud to my, my recollection of the story. She was pr too proud to take them. So we never actually accepted them. But that sort of gives you a sense of the context by which I, at nine years old was trying to find my way. I was a Jewish kid from a divorce household being raised in a neighborhood full of a bunch of Italian American Catholics who had, there were no divorces and they were all upper middle class.

’cause their parents, although it was kind of a blue collar town, but they were all pretty successful blue collar people. So they had a lot more money than we had. So I was poor [00:07:00] Jewish. I was the, pretty much the only Jew I knew or there was only a few of us. Divorced when nobody was divorced, and I really felt like an outcast.

And I was a very sensitive kid, and so I was easy. I, I got a lot of fights as a result of that. Sensitive kids get picked on all the time because they, you know, the other kids get reaction from them and that really, I guess, toughened me hardened, hardened me. That’s probably the right, the right word. It’s interesting that I don’t have, I don’t have much of a memory other than when I think of things that I really think are from photos prior to my, my dad leaving, which is, you know, at the age of nine, that’s too old.

You should have memories earlier than that. Of course, I have some, but not many. It’s, it’s way less than I think the average person does.

David Pasqualone: Yeah, and that’s interesting because there’s a whole psychology that nobody fully understands. You have people who are, you know, they’re hurting and they just go blank.

And some people consciously and subconsciously repress memories, [00:08:00] but I know people that they’ve gone through a traumatic situation and they themselves, let’s say, spoke to a counselor and everything was recorded out of their mouth. And then a few years later they’ve been, their mind was like, rewritten and it’s completely different.

So it’s, it is amazing how we can protect ourselves and compartmentalize. So it’s not uncommon to hear that somebody doesn’t have memories before nine, when their parents went through a divorce. Especially in our generation when there wasn’t a lot of divorces. Right.

David Steele: Yeah, yeah. Certainly these places it’s more common.

Right?

David Pasqualone: Yeah. And what area of the country did you grow up in? Did you say?

David Steele: Right outside of Philadelphia. I was born in Princeton, New Jersey, but we quickly moved. We moved around a bunch. My father was trying to get a tenured position as a professor at the university. He ultimately did a university in Philly and we had moved back to Philly and then to South Jersey.

I was mostly raised a few miles outside [00:09:00] of Philadelphia and south, south southern New Jersey.

David Pasqualone: And did he ever come by and visit you or hang out or did he just leave?

David Steele: Yeah, I mean, yeah. And I mean, I, I, I now know my closet psychologist has learned in me, has learned that my father has a lot of social anxiety and is very mistrusting.

I think he was probably traumatized some way as a young child. And I, he does, you know, I remember he was, I do remember this. I said, daddy, why don’t you have any friends? And he said, son, when men get older, they don’t have friends. He said that to a young child. So he was pretty, he was pretty damaged himself.

But you asked me was he around? I mean, when he, he did the, the required the, you know, the, the socially required every other weekend type of thing for a while. But his heart, I don’t believe his heart was really in it. And the evidence of [00:10:00] that is over time, it became a lot less frequent. He, I would imagine his memory is that I didn’t wanna see him or I wasn’t available.

And, you know, I’m not sure what the truth is with, with that, but the bottom line is we, we’ve ever increasingly saw less of each other.

David Pasqualone: Yeah. And that affects us. Maybe it hurts when we’re teens, but then as we get into adulthood, we don’t realize the, I don’t wanna say boundaries, but the walls we build to protect ourselves, they’re actually unhealthy.

So. W go through their life. You’re in school. Your mom’s a single mom, you’re getting by. But like you said, you’re the only Jewish kid, you know, when you’re in an Italian American neighborhood. I grew up in an Italian American neighborhood in Portuguese. So, I mean, to me it was easy. ’cause my last name’s Pasqualone alone, but did, were you pretty accepted?

Was it hostile?

David Steele: No, no. It, I mean, it wasn’t, yeah, I guess it was kinda hostile. I got a lot of fights. Yeah. You know I didn’t really get in fights once [00:11:00] the latter years of high school was around. I, you know, I was, I was not I wanted to be a GA, a great athlete. I ended up being a very good tennis player.

I was the number one tennis player in my high school. And I really wanted to be a great basketball and baseball player. I was simply a decent baseball player and not good basketball player. Those are what I wanted to be, probably ’cause that’s what the popular kids played. Of course I was good at tennis and so I was even more of an outcast.

There was no tennis, it was, tennis was not big in mine, my school. But you know, it was, it was, it was, school was rough for me, man. I don’t have any friends left. I my best friend since I was nine years old, we met in Hebrew school. And to the extent that I’ve experienced love at first sight with my best buddy Frank, and we met at age nine in, in Hebrew school.

And he is really my only relationship other than my, my brother, you know, other than family from pre-college.

Yeah. [00:12:00]

So I think it’s because of it is just because it was such a, it was certainly a challenging time for me and some of it was traumatic.

David Pasqualone: Yeah. So before we move on to, let’s say, graduating from high school and going on to whether it’s college or the career field, is there anything else significant that’s gonna, I don’t want, whether it’s program you for the future or that’s gonna influence your mindset for the future, is there anything else significant between your birth and let’s say high school graduation that we miss before we move forward?

David Steele: You know, I had a old business partner that I had told that I got cut from my high school basketball team four years in a row. And that damn coach, I mean, come on by my senior year for crying light. It couldn’t put me at the end of the bench, but no, he couldn’t. I guess I was that bad. But he said, man, that says a lot more about your personality that you kept trying [00:13:00] than, you know, pretty, pretty much anything, any other story you could tell.

And I think that was, that was actually pretty big. That was the beginnings of. Me being, I wouldn’t say discipline, but I’d say tenacious. And tenacity is a theme that I think will will, will come up again as as we talk.

David Pasqualone: Well, and let’s go on. So now, when you finished school, I personally hated school.

I love learning. I love people. I love God. But man, I hated school. Dreaded it. Is that how you were in high school or did you have some kind of okay balance or did you just loathe it like I did?

David Steele: I loathed it like you did. And, you know, I did really poorly in my SATs. I think I got a 900, I think I got 600 verbal and 300 math.

That’s how bad I was at math, which people were shocked to hear because I built a, you’ll hear later in our conversation, I’ve built a financial planning company that’s [00:14:00] been. You know, there’s wildly successful by any measure. And you’d think I would be great at math, but I’m not good at that type of math, that formulaic, precise, exact math.

And I, I, the, the way school was set up is you had requirements and I, I, I didn’t really enjoy very many of the requirements. And then when I got to college, I, I went to Temple University for my undergraduate in Philadelphia and got a degree in business. And I can’t honestly say I, I, I, I loved any of the coursework.

I didn’t despise it as much as I despised high school. So I started to, my brain I guess, started to catch up, or my emotions maybe started to catch up with my brain. I’m not sure. So I was able to apply myself and struggled a lot less. And my last two years of school, I had almost a 4.0 GPA in college, having about a 2.0 GPA in my first two years.

So I didn’t, I think I graduated a 3.0. But not, but I, it really took me a while to figure [00:15:00] it out. I will say I took me five and a half years to get my undergraduate degree, and I then chose in my thirties to get a master’s in literature. Specifically focusing on postmodern philosophy as it applies to literature, which sounds pretty hoity-toity and I loved it, and I did that intentionally.

So clearly I love learning and clearly I don’t hate school, but I think it really it, it, it requires somebody like me would’ve required me really being honest about my capabilities and what I desired. And I wasn’t doing that in high school and college.

David Pasqualone: Yes. And we were in a different generation and world than today.

When we grew up, it’s like, you’re a loser if you don’t go to college, which wasn’t the case, but that’s what we are pushed to think. So it’s almost like if you don’t go to college, you felt less of yourself. But then it’s like, well, what am I even going to college for? Especially guys like us who hated school.

So when you went to [00:16:00] college, were you going to just get the degree or did you know what you wanted to do?

David Steele: No, I didn’t. And in fact, I, I got a degree in business and I, if I’m being honest, I now, as a person who’s been entrepreneur and started several companies successfully I realize upon reflection that I didn’t know anything about business in college, even while I was doing my studies.

I, I, I learned nothing about it. I, you know, I mentioned my financial planning company, which I still am, founder and CEO of I, that exists because I didn’t want to be poor ever again. And I went to. At the library, and I looked up my senior year of college when I knew I was gonna graduate. I looked up and I, I looked for the job that paid the most for a four year degree, and it said stockbroker.

And so I said, okay, I’m gonna become a stockbroker. [00:17:00] So I’m glad I went to college because I couldn’t have gotten that, that job out of school without, without a college degree. They, they probably wouldn’t have hired me. And I hated being a stockbroker and I’m, well, we can unpack that a little bit.

But I made money and so that, that was the beginnings of when I’m like, realize my reali realization that one has to be in the service of others. Or they’re not gonna be happy. And as a stockbroker, I was a parasite. No, I was a salesperson. I was not in the service of others. And I, I turned that into what is now a financial planning company.

And we very much know we are in the service of others and feel it every day. But I, that’s a long answer to your question. I had no idea what I wanted to do when I went to college. And even I didn’t really want to become a stockbroker when I came out of college. It was just, I didn’t wanna be poor.

David Pasqualone: Yeah, I can understand that. And I’m sure many of our listeners all around the world [00:18:00] some cultures, you’re born into your position and you’re stuck is what the culture tells you. But within America, we have so many freedoms that people just piss away and waste and complain about, but we can do whatever.

So it’s really a privilege. So now you go to college, you get out. You become a stockbroker. And from everybody I’ve talked to, that is a grind. So talk about how were you feeling about yourself and your life and what did you learn from that?

David Steele: Man, I learned the single greatest lesson any business person could ever learn.

And probably anybody that ever wants to do anything and accomplish anything could learn. And that’s where I took my na natural tenacity and turned it in and added discipline to it. And so there was I worked at a company where it was very much like Wolf of Wall Street, if you’ve ever seen that

David Pasqualone: movie.

Yes, I have. It wasn’t, yeah, it wasn’t, I, I don’t know if I watched it [00:19:00] straight through, but it was one of those movies that’s always on. So I saw bits and pieces at different time. Leonardo DiCaprio. Exactly. Yeah.

David Steele: Yeah. So the firm I worked for was a company called DH Blair, and it was, it was sort of a junior version of the company that was.

Featured in that, that movie. And so we were actually all aware of this guy, Jordan Belfort, who was at that company, Jordan being the, the character in in Wolf of Wall Street. And there was this framework for how to build a business and the framework was make 500 dials a day. This is when you were handed essentially a phone book and a, and a, a desk and a telephone.

And I had a sheet put in front of me that had 500 numbers, one through 500 and then one through a hundred below that, and one through 20 below that. So three sets of numbers. I didn’t leave the office in a day until I had dialed the phone 500 times. If, if I didn’t get [00:20:00] through that still counted. I found statistically that I would talk on average to about 70 people.

If I dialed the phone 500 times and if I talk you, you say 77 0, 77, 0 people per day. That’s a lot of calls. Well, some of them said F off and hung up the phone. You know, still I talked to somebody and some of them were not qualified or not interested, but there were some that were qualified and interested and I found that number to be 10 per day.

So if I dialed the phone 500 times on average, on average, very much average, sometimes there’d be two, sometimes there’d be 20. But on average I get 10 qualified leads. And once I had enough qualified leads, let’s call it a hundred, I could then call and set up meetings to go meet with people, coffee, pitch them on something, whatever.

And now I had [00:21:00] if, and if I knew if I got a a, if I got off eventually 100 pitches, I’d get a client. So you could easily see, I’d have to have, you know, for every a hundred leads, I’d have one client. Well, I was okay with that math, it doesn’t sound great. But now I knew my formula and I knew if I dialed the phone 500 times a day and if I go to a certain number of pitches per week and so forth, and if I was good to my clients, I wouldn’t, you know, now all of a sudden I’ve got the beginnings of a business and that framework, I’ll call that systematic behavior, formulaic, mathematical, systematic behavior, I think applies everything we do in life.

I bet you every professional athlete has some version of that for their training. And I don’t care what kind of business person I, maybe it doesn’t really matter, whatever the discipline is, if you have, if you have a, a mathematical framework and you can chip away at it low and slow, but [00:22:00] consistently you can succeed.

And so I, that was the. You know, that was the beginning. I wish I had had that framework for making the basketball team back in high school. I, I tried out for four years, but I probably didn’t have the daily training necessary to have actually made it. But anyhow.

David Pasqualone: Yeah, and that’s what’s hard in our culture too, because there’s things we love, but it doesn’t mean we’re the best at, and there’s things we’re really good at, but that doesn’t mean we enjoy it either.

So we always, whether it’s our personal life or our professional life, we gotta find that balance. And I’d make jokes in the past, in my career, and I’m sure you did too. It’s like, well, I’d rather be rich and miserable than poor and miserable, right? So that’s a terrible mentality. But when you feel stuck in your career, you’re like, well, I wanna make as much money as I can.

So now it sounds like you’re having the discipline, you’re systematically seeing for 500 calls. You know, I get 2% out of that. 2% I get 1%. So it’s all [00:23:00] math. You know, you’re dialing for dollars. At what point did you just say, whoa, something’s gotta change here? Was it six months in? Six years in? How far did you go before you’re like, I can’t do this anymore?

David Steele: The the, the, the, the, the, the system at this, what turned out to be pretty crappy firm was once you open 30 accounts with clients for the person who was mentoring you, they were, they were the clients of the, of the, of the mentor, not my clients. So I was, they were in essence paying me and teaching me, and I was opening in a return, I was opening accounts or developing relationships with clients that they kept.

Once you hit 30, you went on your own and you began that same process for yourself. And I set the record In nine months, I was able to, to go from being hired to pay, passing my securities test to opening 30. [00:24:00] Accounts with clients. I was a very good salesperson and I was, again, I was very disciplined and systematic, so I was on my own and, and I, I, I, I remember it was 1991 and I went from making $12,000 a year to over a hundred thousand dollars.

And I I, about a year into it, I was really unhappy, even though I was, you know, you just said it a minute ago, rather be rich and unhappy than poor and unhappy. I listen if that’s the binary, which I’ll reject, but if that’s the binary, I agree with you because at least your base needs are being met, so at least you’re, you may be miserable and safe rather than miserable.

Potentially unsafe. So I’ll, I’ll take that. But the idea is to be happy and rich is not necessarily part of the equation by my estimation.

David Pasqualone: Oh yeah. And our listeners know, and I wanna clarify if I misspoke. I mean, we want to be in love with God, in love with our family, have balance, have joy, have peace, and [00:25:00] to be at one with God and our family and have peace.

You can be in poverty or you can have great wealth, and you’re gonna be okay. But what I was saying is that daily grind and going to work, it’s like, okay, well if I’m gonna be miserably either way, I might as well make as much money as I can per hour. Sure.

David Steele: Yeah.

David Pasqualone: So, all right, so now you’re going on, you hit this record, you’re blowing away the competition.

Where do you go from there?

David Steele: Well, I, like I said, I was, I started to make money and I wasn’t happy and I figured what the, I was like, what the heck is going on here? Like, this is weird. This is, I’m no longer probably ever gonna be worried about whether I’m gonna feed myself or be able to have an apartment what’s going on?

And I’ll condense a couple of year transition process into a very quick sort of paragraph. But I, I [00:26:00] realized that I wasn’t adding value to people’s lives. And I knew it, I was really selling them investments that were not fully baked, that were, I, listen, I didn’t have a morality question ’cause I didn’t know I was sociopathically selling something to somebody that was wrong for them.

That’s not what I mean. I just know that these are not, this was not a process that I, that I. Believed was helping people, it was most probably appealing to their gambling instinct, which a lot of people I think, are born with. I think we’re all born to some degree with the excitement of, of gambling. And I think in retrospect, I was selling people investments that really, in their brains fit with gambling.

They, they’re wanting to win and, you know, hopefully not lose rather than being, providing a service. And so I, I was [00:27:00] contemplating leaving the industry and I, but I, I was thinking about going to real estate. I, I didn’t know what I was gonna do, but I couldn’t keep doing it the way I was doing it. And I stumbled upon this field, which was not brand new in the nineties, but certainly not prevalent that was fee-based fiduciary, like financial planning or investment advisory work rather than.

Stockbroker selling people stuff for a commission. And again, I’m condensing part of the story into a simple paragraph, but I went to work for a real firm and people will laugh when they hear the name because during the credit crisis it got, they got in trouble and now they’re thought of as being a bad firm.

But truthfully, it was a wonderful firm called Bear Stearns. And I was so happy there. And I was the first advisor in the entire company of 500 advisors to convert my business to a fee-based fiduciary like [00:28:00] investment advisory practice. And my income dropped 70%. And I was happy making 70% less income because every time I talked to somebody, I knew I was, I was helping them every time.

And my brother. Join me. I was able to convince the branch manager to let him get hired and eventually became my full-time assistant. And he and I began building what is now a pretty successful financial planning company. But we did at one client at a time together.

David Pasqualone: That’s awesome. I always thought it’d be fantastic to have a business with your siblings or your children.

I’m sure there’s challenges with it, but there’s also benefits. So now during this time, did you get married, have children, have you been single the whole time? What has been going on in your personal life while [00:29:00] this evolution is happening in your professional life?

David Steele: Yeah, I mean, I, I I’m sure it’s psychoanalytic, analytic rich territory to unpack why I knew at 14 I didn’t wanna have kids.

It’s not, doesn’t take too much to, it’s not too much of a leap too. Figure out why, you know, see above my earlier story about my childhood, maybe, maybe not, I don’t know. Who knows? I knew I didn’t want kids and I knew I never wanted to get married again. Not too far of a stretch to figure out why that might’ve been.

Mm-hmm. But I did in, in, in when I was 30. I so this fa I fast forward a little bit there. I was single up until then, and I was with a woman as a, as a true partner, domestic partner for nine years, from 30 to 39. And she never, she didn’t want marriage or kids either. And so we just cohabitated and built a life together.

We ended up breaking up, unfortunately, and I’ve been essentially single ever since. But [00:30:00] yeah, I, I I don’t know. That’s a long answer to your question, but

David Pasqualone: No, not at all. I actually, I thought, I thought this my whole life, but just this week I was speaking with a friend about how. Divorce is taken so flippantly and in America especially, it’s common.

It doesn’t matter if you are within the church or if you don’t go to church, it’s just like, Hey, this isn’t working out. It’s, we’re just gonna get a divorce. And I truly believe that no matter who you are, it leaves massive scars on the individuals and more so the children didn’t choose it. It leaves massive scars on the children.

So I think the sanctity of marriage is huge. And this is a guy, I got divorced, you know, I fought for my marriage for 24 years, and it still ended badly. But Are you married now? No. No. You saying you’re

David Steele: single now? Okay. [00:31:00] Yeah.

David Pasqualone: So once I, do you have kids? You, you do have kids? I have two children who are not children.

They’re 23 and 21 right now. Mm-hmm. But’s tough man. It’s like everything, the God or Dean, we have peace and joy. And the way it quote unquote should be when that gets broken, it breaks you, it breaks the children, it breaks the whole structure. So saying uses that to steal the joy. So I can totally understand I’m not judging you.

David Steele: Yeah, no, I don’t. And I don’t feel judged at all. Yeah. And, and I’m, I’m, you know, it, it’s, I’m, listen, I’m, I spent a lot of years in therapy trying to kind of figure this out and I’ve since just accepted that I’m in love with my life. I’m at peace, I’m happy and I’m imperfect. And that’s just, that’s just okay.

You know? And the why may some of those why’s may ne may never be answered. But I did wanna, you had said people get divorced and too flippant away, and I completely agree with you, but let me just tell you, I think people get married. And too flippant away. Yes. Hundred, I mean [00:32:00] hundred. It’s the most important.

It’s the most important contract. You’re gonna s you know, from, I’m bringing, I’m coming at it from a financial planning perspective. I see people enter into marriages and they hear the word prenup, and I think it needs a new name. I think you need to, to call it something along the lines of an agreement, a marriage agreement.

I mean, we could maybe positively connote it and call it a marriage agreement. Let’s talk about what we plan for our marriage and what we plan if our marriage doesn’t work, and let’s, let’s actually get that out on paper because it’s the most important contract you’re gonna sign in your life, and people go and sign it without any analysis or thought just because they feel this emotion.

Yeah. So,

David Pasqualone: no, I agree. I mean, there’s so much we can go dig deep in this, right. But you have two people, which throughout history, people, when you get married, you’re typically young and you don’t know a lot, but you’re in this feeling. But our [00:33:00] elders and the people around us, you know, we’re supposed to instruct our children, but when that family’s broken, like you and I, we had a broken family.

So then when we’re going into marriage, we don’t even know what a good model is. You know what I mean? We don’t see it. I didn’t see a good marriage around us, you know, when I was growing up. So I didn’t even know what a good relationship was. And what you’re saying is people going flippantly because of an emotion and then you can look at it exactly like you were saying, from a financial perspective, you know, there’s huge consequences to divorce.

Right. But coming at it from a Christian worldview. There is not even divorce. It shouldn’t even be an option. ’cause I’m not making the vow just to my spouse. I’m making it to God. So for me, divorce was the last thing I wanted. And in biblical terms, I believe there’s only one. I personally believe, again, I’m not, if you got divorced 10 [00:34:00] times, I’m not telling you, you know, you’re burning in hell.

That’s between you and God. But what I’m saying is I believe the only reason for divorce biblically is adultery. And even then you try to fight for the marriage. So I had the biblical out, but man, it ruined me. It ruined the relationship between my children and I and it just, who knows how many generations that could influence without God’s intervention.

So when you’re talking about seeing it from the financial perspective, I mean, how many men and women do we know? They’re in their forties, they get divorced and they start, they literally have less money than when they’re in college. Right.

David Steele: It’s a mess. And, and from, as a financial planner, I have seen people with more than enough wealth for their grandkids to never worry.

And the divorce happens, the trauma emotionally on both parties and not to mention the kids and the amount of money, 99 out of a hundred times, that ends up in the lawyer’s pockets because they are [00:35:00] motivated to have you fight. And they’ll, they’ll, they’ll, they will make you feel like they’re on your side, your lawyers on your team, and your lawyer has your best interest in mine and the other, your spouse’s, lawyers on your spouse’s side.

And they will do the same thing. But they subconsciously at best will want to see the fight extend and be as deadly as possible.

David Pasqualone: No, and that’s true. Anybody who knows me. I’ve said that before. I said that during, and I’ll say that for the rest of my life. ’cause it’s true. The only people who win from divorce are Satan and the attorneys.

Our legal system, especially in America, is completely backwards. It’s not about right. It’s about exploiting both parties. Right. And it’s gonna exhaust you financially. When I went into my divorce, David, I refused to use an attorney. I’m like, I’m gonna do the right thing and that’s it. And if our system doesn’t protect me from doing the right thing, [00:36:00] God’s gonna take care of me in the end.

And he did it. I went through the process and you know what happened in my divorce? I don’t know what state you are in, but you know different California. Huh?

David Steele: I’m in California.

David Pasqualone: You’re in California. So the average divorce takes X months, sometimes years, right? Once we file for divorce, we were done in two to two and a half months because I didn’t get an attorney.

And the,

David Steele: you have a

David Pasqualone: relationship with your

David Steele: ex?

David Pasqualone: No, she was a whole she. No, no, no, no, no. My relationship. You might

David Steele: wanna edit the beginning of that out, huh?

David Pasqualone: Oh no. I don’t even care. Truth is the truth. My relationship was basically the Jerry Springer show meets The Good Son, meets the Twilight Zone, and she was a gaslighting narcissist that manipulated everything, even messed my own kids’.

Heads up, I, I’ll take a polygraph today and when I face God, I got a clear [00:37:00] conscience, but she hurt me and the relationship between my children and I a lot. Now, other people, I could care less what they think of me. If they wanna believe the a lie they should have the discernment. I could care less. But when it goes back to the courts, I had her attorney on the phone and I’m like, you know, we could go in the whole story, but I just basically said, Hey, you’re speaking lies.

I’m not gonna waste my time with you. I’m certainly not paying for you. And if you want to, you know, this is what I’m willing to do. If not, you do what you gotta do. And then he ended up hearing what I had to say, seeing that my ex wasn’t telling the truth, so it was just like, this is what he’s gonna do.

Or we go to court and I was just like, you want to give all your money to the attorney, or you want to actually have something to exploit me by, you know, so it was like, you, you wanna put the [00:38:00] money in your pocket or you wanna let the attorney put in his pocket. And that’s how I handled it. But we went, the attorney commented, and the courts, the, the freaking judge said, I’ve never seen a, a divorce go so fast.

But that’s because. I refuse to use one. So what you’re saying and what you see every day is, as a Christian, I do believe in the sanctity of marriage, and I do believe people can love God and love each other and stay married a lifetime. But statistically, man, there’s like, what a 60% divorce rate in America right now.

So it’s kind of hard to say get a prenup, but using earthly wisdom like, yeah, prenup smart, right? So I, I, let’s call

David Steele: something different. Let’s, let’s, let’s change the, because prenup is negative, negatively connoted. Let’s, yeah, let’s call something more positively Connoted, and let’s plan for what our marriage will be like, and if, God forbid, our marriage doesn’t work, what it’s gonna be like and [00:39:00] how we’re going to agree to end our marriage.

David Pasqualone: Yeah, I mean, contracts are only as good as the people who make ’em, right. The only thing you have is if you have something that’s legally enforceable, just to put boundaries and guidelines. Yeah, I can understand that perspective completely. I’m not gonna say I’m right, or you’re right, or I’m wrong, or you’re wrong.

I don’t even know anymore what the right thing is, other than when we make a vow of God, we keep it. Right. So with you though, you’re seeing this every day, so that further must, like you already had, you know, what you learned in childhood and now every single day you’re seeing marriages go south and wealth be destroyed.

I mean, I can’t imagine you not having reinforced, you don’t want to get married, so, yeah.

David Steele: Yeah. I love people. By the way, though, I have a, I have, I love, I I, I have so many people in my life that I love, that I have deep, long, lifelong [00:40:00] relationships with, and I get a lot of what I think. And, and again, I, I never, I, I didn’t want kids, which I mentioned, and therefore it wasn’t like.

I had to be married to protect sort of the family unit. Right. I so but you know, I never thought about whether early on when I was in finance seeing the mess that divorced caused. Mm-hmm. I’m not, I wonder if, you know, maybe that was just the period of the end of the sentence for me. I was, you know, my predilection was to not get married.

But then it was like, there’s no way after seeing what people go through.

David Pasqualone: Yeah. And all of us, we have to be honest with ourselves and with God. And for you, your story’s different than mine. But there could be a lot of similarities. But I think just human nature across the board, even if you’re on the fence, when you’re seeing disaster after disaster financially, you’re gonna be like, oh yeah, I’m not doing that.

I’m not going down that route. [00:41:00] Dink, I am double income. No kids. Right. I mean, that’s kind of how people think.

David Steele: Yeah. Yeah. I, I hope there aren’t any listeners that decide they’re not gonna get married. That’s not the takeaway from what I’m trying to express. The the takeaway is just go in, go in eyes wide open and try to be mature about it, where you really think through what you want your life to be like as a married person.

David Pasqualone: But wouldn’t you, wouldn’t this, if somebody’s listening to us, they can blame me, but wouldn’t them, if they can’t finalize the marriage based on something we said, that’s probably a good reason not to get married. That’s something you gotta be a hundred percent all in before you commit to it. And I personally think there’s so many great books written after the train wrecks of people’s relationship that I think that should be like required really before you get married.

Because you can see like, [00:42:00] oh damn, I need to really be careful, like, you know. When this thing, when things aren’t going well, are we in this together? Does this just feel good now? I mean, how many people, they spend five years and $5 million to plan for a wedding, and when the wedding’s over, they’re bored with life.

Right? It’s like that, that’s like the highlight of their marriage is their wedding day. That’s not how it’s supposed to be. But going back to you and your story, I mean this, hopefully it helped people but going back to your story, David, so now you and your brother, you start an organization the fiduciary model, is that something you kept or is it what model we talk about your business

David Steele: now and how you run it.

Yeah. We were at Bear Stearns and like I said, my brother and I sort of built the business. I I say it one client at a time and little by little we, we became successful by most people’s measure. And, we were happy, very happy. I think we had [00:43:00] three assistants, two or three assistants with us when the credit crisis hit in 2008.

And JP Morgan bought Bear Stearns in the middle of the credit crisis for $2 a share after the stock. I think it dropped it from 144 to two. And so JP Morgan, so all of a sudden I woke up one day and I was no longer an employee of the firm I loved, but I was an employee of JP Morgan. And what Bear Stearns, my brother and I, and all the other people that were advisors, again at that point in time, many of them had moved over to what I saw early, which was this fee-based fiduciary like model for advisory to clients rather than this financial stockbroker type sales approach.

At JP Morgan, even more people were, had that type of business. So intellectually and sys, the, the, the [00:44:00] platform that I had access to at JP Morgan was even better than we had, had had at Bear Stearns. But there was one big difference. It was not an entrepreneurial environment at Bear Stearns. They allowed us to run our business our way.

And their theory was, if it’s moral, if it’s smart if it’s thoughtful, we’ll find a way to say yes doing that kind of business. And you get to decide what that looks like. And it was really a spirit of an entrepreneurial type spirit. I’m by my nature, I think I’m an entrepreneur. Well, I wake up one day and I work for a big bank and that was not entrepreneurial at all.

And we stayed for a while, but eventually we, we got really unhappy and we. We ended up leaving to start our own company. There’s a reason why I had such confidence to be able to leave and start our own company. It’s because I had opened a restaurant we didn’t talk about all through high [00:45:00] school and college.

I had worked in restaurants and I loved the restaurant business and I didn’t think I could have financial security opening a restaurant, but I really wanted to coming outta, coming outta college. And I’d worked for a bunch of very talented but not business people, not business-like people in the name of the chef owners that I worked for in high school and college.

So I, you know, I began this. Finance path. About 15 years into it, I was still at Bear Stearns and I wrote the business plan for a restaurant. And Bear Stearns again being entrepreneur said, yeah, you, you know, it’s okay. Go, go open that with a, a partner as long as you’re spending the majority of your time on your financial planning practice.

Sure, go do that. And we opened, I, I found a chef partner and we opened what ended up being 16 years later, one of the most successful restaurants in the history of San Francisco. [00:46:00] It’s a restaurant called Flour It Water, like the ingredients for dough. We spell it Flour plus water, but it was the first restaurant.

That restaurant has turned into a restaurant company with. Seven restaurants now and a consumer packaged goods business and lots of grocery stores, dried pasta, frozen pizza in stores, and we’re opening probably two to four new restaurants a year is our future strategic plan. So I had opened my first restaurant while at Bear Stearns.

Now JP Morgan buys us and I’m like in this bureaucracy and I’m like, I open restaurants, man. Opening a small financial planning company is gonna be easy compared to that. And so I convinced my brother and my, we had two other partners at the time, we who we made partners in the, in the practice and our assistance.

I convinced everybody to leave JP Morgan and start our own financial planning company, which we did 10 years ago, called One Wealth [00:47:00] Advisors. And we left JP Morgan with about 250 million. Of assets under management. And we have grown that in 10 years to where we now have $1.3 billion in assets under management.

And we’re a 13 person team with about 400 clients. So there’s there, there’s my, there’s my professional path in a nutshell.

David Pasqualone: Yeah. No, and that’s incredible. Remarkable, right? So talking to our audience, we all have pain, we all have distractions. We talked about tenacity, we talked about discipline, we talked about structure.

What are the things, you know, somebody might be 20 years old listening this, just starting their career. Somebody might be 50 years old, right? Somebody might be in between. What advice do you have for them to keep moving forward, to stay focused, and to achieve that success?

David Steele: Well, I do, I believe that a career choice should be.

[00:48:00] A balance between do what you love and love what you do. That is to say, I don’t care what business you’re gonna go into or what industry you’re gonna go into, whatever you’re gonna do professionally, you will, no matter what it is, I should say, almost everybody will inevitably wonder if they’ve chosen the right path.

That is to say, are they really doing what they love? And some people are clearly doing what they can’t stand. Okay, well that’s, that’s probably an obvious choice. But I think there’s love what you do, which is find, you can find satisfaction and joy, especially if what you’re doing, you can look in the mirror and know that you’re adding value to human beings.

You’re adding value to people’s lives. You can find a way to love what you do. So I think. It’s, it, it’s, a lot of people say, well, make sure you do what you love. And I would say, okay, yeah. And also love what you do. That is to say, if you have a feeling like [00:49:00] you don’t, certain days, months, love what you do.

Well, maybe there’s some mental gymnastics you need to do to, to love what you do. And the number one thing I would tell people in life is, spend less than you make. Always spend less than you make. Don’t borrow money. The only type of debt that I ever would call good debt is the debt required to buy a home that you’re gonna live in as a primary residence.

That is, as opposed to having to pay rent. You gotta live somewhere. So maybe that’s good debt and mortgage loan. Otherwise, if you can’t afford to buy it with the money you have, don’t buy it. Keep your spending. Less than you’re making. If you are always spending less than your making, you will never have financial anxiety.

I mean, it, it really is that simple. So I find a lot of young people don’t wanna delay gratification. I [00:50:00] blame our culture and our finance industry about where we extend credit to people to easily, and inevitably it allows people to you know, not delay the gratification to get the gratification now, pay for it later.

And that’s a vicious cycle that, you know, best case scenario, they make so much more money, they can eventually pay off their debt. But worst case scenario is it continually, you know, pulls you down emotionally. It’s like an anchor.

David Pasqualone: So I agree 100% with you, David. And the Bible says the borrower is servant to the lender.

And our society makes our children and our slaves, right? Oh, you need to go out and buy a car. Okay? They get a car payment, their insurance is through the roof. They’re spending all their time working just to be chained to that car, right? So right from the bat, like you said, at the [00:51:00] age, they’re getting credit, they’re being enslaved.

But what’s interesting is the people I’ve met in the financial advising space and the stockbroker space usually don’t admit that publicly because they’re telling their clients something contrary. So I find that super interesting and I’m very I respect it a lot because that’s not the standard I remember working at when I was in college.

You remember gateway computers? Of course, I remember Gateway computers, and back then, you know, computers were like two grand. On average, a laptop could be up to $9,000. And I remember the financial advisors making 250, $300,000 a year. Back then, they couldn’t pay for a laptop or a computer in cash. And their credit was so bad they couldn’t finance it.

So it blew my mind that the people that were saying they were experts and with money couldn’t even buy a [00:52:00] computer with cash, let alone finance one. So to hear you say it, obviously you’ve seen people ruin themselves, extending themselves with credit. So when people are starting a business, ’cause I’m with you, other than my a home, I don’t think you should finance anything.

But how do you recommend people on the entrepreneurial path to not, you know, go into debt, but still start that business

David Steele: Equity, sell equity. Don’t borrow. I have this debate whenever I do any consulting for, with, with entrepreneurs. ’cause I’ve, I have had formal consulting arrange arrangements with people who have hired me because I’ve, I’ve started, and I didn’t mention some other businesses I started.

So I have a little bit of a reputation, especially in the Bay Area as a serial entrepreneur, I suppose. And I, first of all, when I [00:53:00] agree to take on a prospective con consulting client, I ask ’em a bunch of financial planning questions to see if they’re heavily indebted, which you think that all I really care about is I’m being hired as a consultant.

Are you gonna pay me? But what I care about is the sustainability of the business that the entrepreneur’s gonna start. And if the person is on weak financial footing, they’re not really in a position to become an entrepreneur. So I would tell anybody who’s contemplating being an entrepreneur. Make sure your balance sheet is strong and your income is solved at least for a period of time.

If you’re indebted, you’ve got dependence and you’re living paycheck to paycheck and you think you’re gonna start a business, and however you capitalize that startup cost for the business, whether it be borrowing or taking an equity right outta the gate, you are depending upon that brand new business that may [00:54:00] not right away have positive cash flow, but you’re depending personally on generating cash flow enough to cover your, your debt payments and your dependents, et cetera.

So I would say start there as an entrepreneur. Make sure you’re, you can, you have a financial platform to actually be an entrepreneur. But secondly, when you go to finance the business, listen, it is a, it is way easier to fill out an SBA loan paperwork or. A bank loan or whatever than it is to put together a pitch deck and go out and pitch people to own part of your business.

And you can rationalize it by saying, well, if I can borrow money and pay it back, I get to own a hundred percent of the business. And if I have to give somebody equity, then they’re gonna own a percent of the business forever. Well, that’s true, but there’s something in my finance world called risk adjusted [00:55:00] returns and risk adjusted returns.

Often it’s a mental calculation you’re doing. It’s not exact, it’s imprecise. But you’re saying, okay, I’m gonna invest in this thing. Let’s say it’s a US treasury bond. My risk adjusted return is a hundred percent equal to my return. That is to say there’s no risk. Treasury bonds are riskless. So if you’re gonna get 4%, your risk adjusted return is 4%.

Well, if you buy a stock, you hope to make 10% and you understand that there’s a risk you’ll make, you’ll lose money, right? And, and so we’re always doing this calculation of a risk adjusted return. People with wealth, especially extreme wealth, inevitably are gonna carve off a portion of their assets and invest it.

In private individual companies, local companies call it 5%, sometimes 10%. If they’re aggressive in that regard, they’re gonna do it. They’re gonna find those companies when they invest in that company, let’s just say [00:56:00] the, an entrepreneur listening to this podcast has an idea, and they find a rich person that is gonna write ’em a 25 or $50,000 check to own a small piece of the company.

That person writing the check is gonna do a calculation, and they’re gonna say, what’s my risk adjusted return? Now, if it’s a restaurant, the risk adjusted return is. I I, with these projections, I can make 20% a year and I can lose a hundred percent of the investment, my risk adjusted return. I can do that calculation and I’m comfortable with it.

It’s calculable and I like it. It’s fine. For this portion of my net worth, I then ask the question, what is the risk adjusted return of the entrepreneur who didn’t put all of their own capital into the investment or didn’t borrow the money? What is the risk adjusted return of that entrepreneur? And the answer is, it’s infinite.

It’s infinite because it’s not calculable. There is no risk. You’re using other people’s capital and they’re taking risk on a risk adjusted return expectation basis that they’re comfortable with, [00:57:00] and you are taking capital from them, very symbiotically, and you have an infinite risk adjusted return because you can only win.

Yes, you’ve given up a piece. Even though your return is less than if you owned a hundred percent, your risk adjusted return is incredible. So I always, when I’m launching a business take in equity investment, or when I’m consulting, or when I’m advising, when anybody talks, talks to me, I’m like, take equity investment.

Don’t borrow money.

David Pasqualone: Yes. And talk about the pitch process. Because for myself and anyone who’s gone through raising capital and making money, or you know, utilizing money through investments, instead of putting all on your own, it doesn’t even matter if you’re just trying to sell idea to the company you work for.

When you pitch an idea, especially to qualified people, they’re gonna blow [00:58:00] holes in it like crazy. And you are gonna learn and gain so much if you’re not ready. Right.

David Steele: Yeah, completely. I, I, there’s a saying that I heard a long time ago that I pretend like I made it up. I certainly didn’t, ’cause I think it’s been said since the beginning of time.

But it is as follows, if you want advice from someone, ask them for money. If you want money from someone, ask them for advice. And I believe what’s underneath that, that that philosophy there is that when you ask somebody for money, their guard goes up. They know they’re being sold, and it’s hard to break through that guard.

But if you ask somebody for advice, what you’re doing is complimenting them. You’re celebrating their intelligence, their humanity. And when their guard is down, they inevitably want to help you. Now, I’m not saying, again, it would be sociopathic if you’re not actually seeking somebody’s advice, and [00:59:00] really what you only want is their money.

But what I would say to somebody is first of all, come up with a pitch deck. And I don’t care if you’re not gonna raise money, if you’re starting a business that doesn’t require outside capital, and there are plenty of those, you still should come up with a business plan that you should turn into a visual pitch deck.

I use those pitch decks, which really are strategic business plans for the business to show to potential employees. To show to landlords who I may lease a space from. When you have a really beautifully, fully baked business plan that has turned into a visual pitch deck for your business plan, you have something that has magnetism, it’s gravitas, it really makes you look like you have your, you know, you know what together, like you’re, you’re ready.

And then to go to your most trusted network of hopefully rich people and say, Hey, I’m starting this business. I would really love to get your advice on what [01:00:00] you think of this idea. I am not here to pitch you on the investment. I wanna show this to you. And you do that with the first five people or 10 people that you truly want to get their feedback on the business plan, assuming you’re trying to raise capital.

And on the concept, let them poke holes in it, evolve the deck, evolve the business, and now you’ve got. Even more of a fully baked business plan. Oh, and by the way, it’s pretty probable that of those five people you asked advice for, a couple of ’em are gonna invest. And the minute somebody invests, they’re either going to, they’re gonna become your ambassador, they’re gonna start proselytizing, and they’re gonna tell their friends because they’re very excited about it.

Plus they wanna validate their decision to have invested with you. And so they actually want subconscious validation. And so they’re have a psychological vested interest to introduce you to their network and so forth and so on. So that’s, does that answer your question?

David Pasqualone: 100%. No, 100%. I just know that a lot of [01:01:00] people, they’re like, if I share my idea, somebody’s gonna steal it.

And there is some truth that you need to be wise, but when you’re looking to borrow or you know, money, like you said, you sign up and now you’re in debt. But when you go to someone to pitch them. To invest in you and invest in the company. The idea, the process, whatever it is, they need to believe in it. So they’re gonna point out all the flaws, ladies and gentlemen, that you need to address.

And they might be, they’re not might, they’re probably gonna be things you never thought of. ’cause they’ve been there and done that and you haven’t yet. So they’re gonna help you 15 years of your career and losses are gonna be avoided if you just listen, be humble and listen. That, that’s my opinion. David, what do you think?

You gotta

David Steele: have the hu you gotta have the humility, right? You there there is an intersection of confidence and humility and I think, I don’t think that [01:02:00] if you, if you get information that deconstructs an assumption you made about your business. The, the, you know, I’ll, I’ll give you a story. We’re, we’re my, my restaurant company, of which I’m founder and executive, co-founder and executive chairman of, we’re about to raise $9 million of equity investment for our next round.

We’ve taken our company from 12 million to 26 million in revenue in the last three and a half years. And we’re everything we’ve invested, we took in 4 million of capital and we went from 12 to 26 million in revenue with only 4 million of fresh capital. Pretty good. So we’re now, we’re gonna raise, we’re gonna raise 9 million.

David Pasqualone: And how many brands do you have and how many locations? ’cause that’s a massive operation really.

David Steele: It’s really, it’s, it really, it’s in essence one brand. We’ve got currently seven locations. We’re opening a bunch more, but we’re scaling the flour and Water pizzeria concept. [01:03:00] And the flour and water brand is attached to both dried pasta and frozen pizza.

And that’s actually where my story goes. We launched dried pasta first. Four different shapes and about 60 grocery stores. And the sales in the Bay Area were, were through the roof. The sales outside of the Bay Area where we tested it weren’t so strong. And it’s a really tough category. We have a board of directors and our board is like, stop pitching on the pasta.

It’s okay to keep it if it’s not a distraction, but people are not gonna invest in your company going forward because of the striped pasta. We launched frozen pizza in 15 grocery stores just as a trial, and we cannot keep it on the shelves. It’s selling like crazy. And so this pitch deck, I have a three person board board of which very seasoned friends, confidants.

I mean, these are, these, these guys are just [01:04:00] incredible. And all three of them in our alignment don’t even put dried pasta in your pitch deck. And my instinct is like. No, it’s, we care about this and we, you know, and, and so, but guess what we’re doing? We’re not putting pasta in our pitch deck. And it’s, but we’re very confident, like we’re like we are amongst the more successful Respir tours in, in the Bay Area and across the country.

Like we’re, we’re really good and so we’re confident in that, but we have the humility to take this advice so that that’s a real, that’s a real world in the moment. Example. ’cause we are putting this pitch deck together as I talk to you.

David Pasqualone: Yeah. And ladies and gentlemen, David and I are kind of smiling and laughing and there’s humor in this, but his humility to listen to his board could keep him from huge failure and losses.

’cause he might be passionate about this pasta, but that those other three individuals see something. That’s not [01:05:00] registering his brain. He’s being, he’s protected, or he might be the visionary that invented the greatest thing in the world and they don’t see it yet and they’re holding him back. But when you have so much on the line, you need to really weigh is it worth the risk?

And like you said, at this point, it’s not worth the risk we’re gonna shelf it for now and move on. Right. Yeah. Well the

David Steele: conclusion was, the conclusion we made in that example was that investors who are gonna invest in us with the type of capital who raising is likely gonna be institutional investors.

It’s no longer wealthy people who are gonna write us 1500 thousand dollars checks. It’s likely gonna be larger institutions that are gonna write us million dollar plus checks, and they are seasoned investors. CS and professional investors, they’re not gonna be interested in the pasta story because the [01:06:00] pasta story is just, it does it, it’s gonna, it to the extent that dried pasta is gonna succeed, it’s gonna succeed over a generation, not over 12 or 24 months.

These investors, they wanna see hockey stick like growth, and the their point is, if the investor feels that we’re focusing too much energy in something that is not going anywhere fast, that we’re not going to be a company they’re interested in investing in. And we do want to grow fast. And so we wanna be, we want our business plan to be consistent with what we’re pitching investors.

So we’re not getting rid of pasta, we’re just not gonna be tripling down on it and focusing on it and allowing it to be a distraction. So.

David Pasqualone: No, it makes total sense. So, yeah, I just hope, ladies and gentlemen, I hope you’re hearing, you know, continue the conversation with David after the podcast is over. But all of us have challenges and, and different struggles and [01:07:00] different biases and all different passions and distractions.

So it’s, you know, the Bible says a false balance is abomination to the Lord, but a just weight is his delight. So we gotta make sure we’re balanced and, and that’s what David’s been talking about this entire show. So thank you. So David, I gotta ask you, between your birth then and today, we kind of even already talked about where you’re headed next, but anything that you wanna share, whether it’s about your life directly or advice to listeners, anything else we missed before we wrap up the show?

David Steele: I would just emphasize, again, being in the surface of others, if I think about my financial planning company, it’s pretty obvious how we now see that we’re in the surface of our clients. And we’ve had the same clients for, we started 30 something years ago and we rarely lose a client and they stay with us.

And it’s, it’s must be because we’re adding value to their lives. And I, I think rightfully believe that our [01:08:00] consumer packaged goods products for the restaurant company and the restaurants we open are delicious. And we are certainly in the service of them, literally from a hospitality perspective.

But I also see myself in the service of my friends and my family. Every day I wake up and I really think about what. Can I do to help this person live a happier, more peaceful life, and I don’t care who it is. And that I, I really deeply believe that that is what we all ideally should be doing. I’m not a very religious person and, and you’ve referred to your religion and, and God and I, I really, whatever the framework we need to get to the point where we’re, I am listening to Jesus’s message.

Right? My goodness. Like, even though I’m not religious, I absolutely believe there’s a consistency across all of the, the great religions and the great philosophies, and I don’t think there are too many of them out there that talk about anything other than [01:09:00] be good to people.

Yeah.

Be good for, be good for people.

David Pasqualone: So now what are you doing with your great success? Do you have a plan with your employees and your people that you’re like, let’s give back, or let’s take part of our profits and put it into something? Or do you just do that privately at your discretion? Like, do you have a formal business? Is that part of your formal business model, or how do you handle that?

David Steele: Yes and yes. So my financial planning company, we currently give 1% of profits to Phil Philanthropy, and we do that. We have a 13 person team and we match Anytime clients give, I shouldn’t say anytime. Many times when clients give to a charity, we know about it because they’re doing their charitable giving through us.

And when we see it, we often. We don’t [01:10:00] do a complete match, but we, we match something from our own company’s profits. And then when a team member gives to a organization they care about, we, we do the same thing. We, we will match for them. And so that’s what we’re doing with the financial planning company.

We a, have an aspiration to give 1% of sales and we’re getting closer to feeling comfortable that we can do that. Currently we do 1% of profits, but 1% of sales would be a much bigger number. And then with my restaurant company, it’s interesting, we talked earlier about. Kids and estate planning is a big part of what we do in the financial planning company.

And so therefore, I’m not one of those cobbler’s kids, has no shoes. Like I have a really good estate plan and my in my estate plan, my, this, my equity in my restaurant company that I started, like I said, 16 years ago and is now turning it to be worth something in my estate plan. All of my equity goes to a nonprofit organization that my restaurant company started.

[01:11:00] And I believe that the the, the restaurant industry is very dependent upon immigrants. We don’t have to get into the politics of illegal versus legal immigrants or any of that. We’re dependent upon immigrants full stop. Whether we, without that political debate about illegal reil legal, and these are people who we, I believe.

As I like to say, we’re built. Our restaurant company is built on the backs of these incredibly hardworking immigrants and many of them are not financially secure and they, they suffer, they have food safety issues. And so we’re, we’re very, that, that nonprofit’s very interested in maybe trying to chip away a little bit about that.

Helping immigrant restaurant workers with food safety. But the one thing I wanna do, and this is to teach people to fish for themselves I would like to ever increasingly start investing in legal immigrants. [01:12:00] I could say that ’cause there’s gonna be business owner, legal immigrant restaurants to start up.

Because here’s the thing, when I opened my first restaurant, I knew instinctively ’cause of my business background that I was gonna need ample capital to the tune. It was $600,000. And so I went and pitched, as I said earlier. 10 people who gave me $600,000 and we opened our first restaurant and we have since then distributed back millions of dollars from that 600 grand.

So they’ve made a lot of money and they’re very happy. Here’s the point, though, I knew it was gonna take 600 grand and I knew I didn’t wanna work at the restaurant and meaning, I didn’t want to physically be a laborer at the restaurant. Of course, I had a day job and I wanted to be an owner and a strategist and not a a, a laborer.

And what I believe is a lot of immigrants, when they see a path to opening their own restaurant, they don’t understand that they’re gonna need ample capital to not be buying themselves a job. [01:13:00] That is to say they’re gonna open up their little Italian restaurant of the little. Mexican restaurant or the little Indonesian restaurant or Chinese restaurant or whatever it is.